Want to learn how to save money? Try the 5k Saving Challenge. This challenge, which begins every year on January 1st, will help you learn how to save money in multiple ways, such as by lowering your energy costs, paying off debt, and building an emergency fund.

It is also fun because it encourages you to compete with friends and family members to see who can reach their savings goal first.

Since 2022 is going to end in a few months, and if you haven’t been able to save money till now and you want to prepare for 2023, then follow this step-by-step guide on how to prepare yourself financially so that you can start saving next year.

How To Get The Motivation To Save Money?

To get motivated to save money, think of your goals and how much you would need to save in order to achieve them. Figuring out what you want will allow you to focus on saving the right amount of money, rather than just saving money in general.

Make a list of things that would make your life better, and then set aside some time every week or so to work towards those goals. When they are met, celebrate your achievements with a nice dinner out with friends or family.

If you need some motivation to save money, try these tactics to keep you on track:

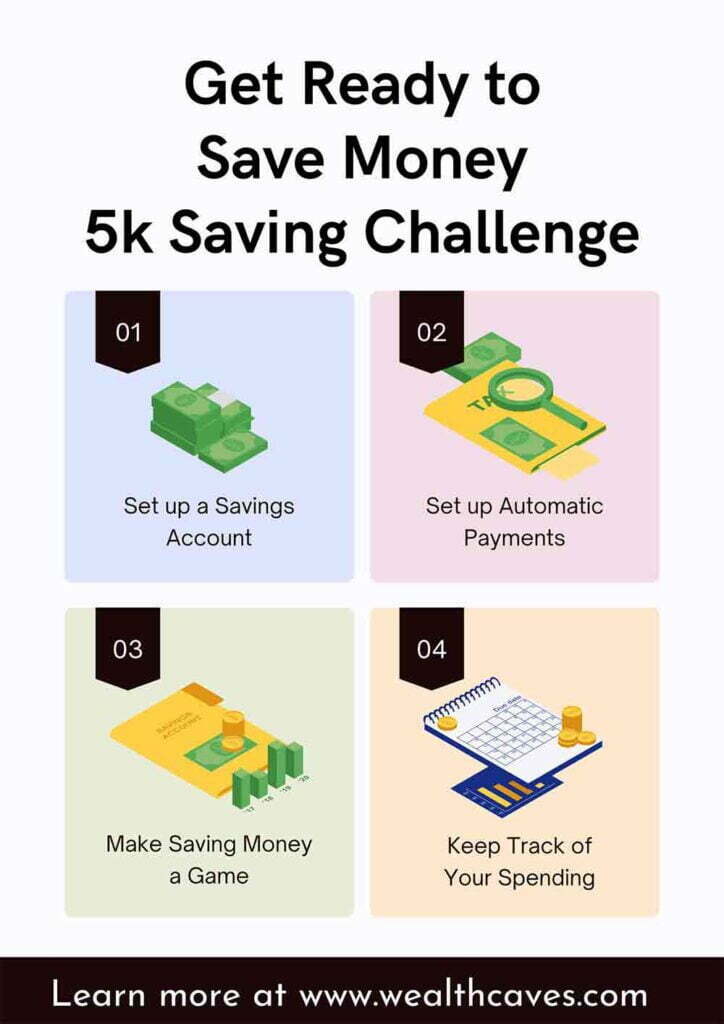

- Set up a savings account and use a company app like Chime or Square to transfer money automatically into your account every time you get paid.

- Keep track of your spending by using an app that connects with your bank account and categorizes your transactions so it’s easier to see how much is going where.

- Set up automatic payments so that bills are paid before they are due each month.

- Make saving money a game and set aside a small amount at the end of the week as an incentive.

The 5k Saving Challenge for 2023

If you are looking to save money in the new year, why not take on the 5k saving challenge? It is a great way to kick-start your savings and learn how to spend smart. Here is what you need to know about the challenge and how should we do it to save money:

Planning Your Days

With the economy getting worse, saving money is more important than ever. You can start at any time, but it is suggested that you start on the first day. This way, by the end of the month you will have saved an extra $1,000. Make sure to plan your days to make it easier to save money in 2023.

If you are planning your days, there are a few things you can do to save money. One way is to make a list of the things that seem like they eat up most of your time and see if there are any ways you can minimize them. Here is what you can do:

- Find out how much you need to save each day to reach your goal of $5,000 by December 31st, 2023.

- Figure out what percentage of your income you want to set aside daily.

- Establish a schedule that will allow you to put away enough money each day with the least amount of hassle possible.

- Figure out what spending habits are holding you back from reaching this goal (e.g., soda or coffee). Maybe you are paying for too many memberships or ordering takeout every day. Identify these behaviors so you can work on them.

Week One Outline:

The first week of the challenge is all about understanding your spending habits. To make it easier, we’ve put together a list of things that you should track.

- How much money do you spend on coffee and other drinks?

- What about lunches out? Can you pack your lunch instead?

- Are you spending too much money on clothes and beauty products when there are cheaper options out there? If so, do your research.

Armed with this knowledge, you will be able to make smarter decisions in the future.

Week Two Outline:

Week two will be all about cutting out your subscriptions. Your first step is figuring out which ones are worth keeping and which ones need to go.

The most important question you should ask yourself is whether or not there is a cheaper alternative that can give you the same service. If so, go ahead and cancel it.

It doesn’t matter how low the monthly fee may be, it will save you more money over time by switching.

Another thing to consider is how often you use the subscription. Some might charge an outrageous amount of money just for a couple of uses.

Week Three Outline:

Week three of the challenge is here, and by now you should be feeling more comfortable with what is going on.

- For this week, it’s time to start looking into ways to save money on your mortgage and utilities.

- You will want to check out your home insurance as well. When it comes to saving money on utilities, take a look at how much water, electricity, or gas you are using each month and see if there are any areas where you can reduce usage.

- Other places where you might be able to save some dough include checking credit card balances or cash-back rewards programs. Some stores offer gift cards when you spend a certain amount. If you are buying anything from Amazon, make sure that Prime has benefits that outweigh the cost of membership.

Finally, remember that there are plenty of apps out there designed to help people save money, But don’t feel like you have to download all of them right away. Just pick one or two and see if they work for you before getting overwhelmed.

Must Check: Ways You Can Help Your Investment Survive During Recession

Conclusion

Although this challenge might seem intimidating at first, it’s actually a really great way to save money and prepare for your future. It takes only five months of discipline and patience, but in the end, you will be so glad you did. Try it out and see how much you are able to save. Let us know who all are going to take the 5k Saving Challenge can comment below.